What is Finazon?

Finazon is a marketplace for financial data. We serve as a bridge: on one side, we connect with publishers possessing financial datasets; on the other, we link with buyers searching for this data. Moreover, we're not just facilitators – we also create proprietary datasets from scratch and sell them, positioning ourselves as another publisher.

What is a dataset?

A dataset is, as the name suggests, a collection of data. Think of it as a table (similar to an Excel sheet) filled with numbers, though it can also include textual information, files, and even images. The nature of the data varies with the dataset: it can be stock prices, forex exchange rates, balance sheets, and so much more. Usually, data is provided either with real-time updates or historical data.

For instance, consider the stock market. A dataset might store the company's stock prices at various points in time (e.g., at 1-minute intervals from 2020 to 2023). Notably, the dataset doesn't store the actual shares (we’re not a trading platform or brokerage); it merely tracks their value over time.

You can view dataset examples in our catalog. Each tile on this webpage represents a distinct dataset.

What is the financial data?

Simply put, financial data are numbers that encapsulate information about a company's operations, currencies, or even an entire economic sector. Companies monitor various financial metrics, including prices, revenue, expenses, EBITDA, profit, etc. Public companies — essentially those whose shares are publicly traded on stock exchanges — disclose these metrics. Investors then use this information to decide whether to buy or sell a company's shares.

In addition to companies, numerous other data asset classes exist, such as stocks: crypto, indices, forex, ETFs, and stock-related news, to name a few. To delve deeper into each category, a quick Google search can be pretty enlightening.

Who are our users?

Our clients range from individual users that can use the data for research, education, investments, tradings, analysis, etc. Up to Enterprise clients that can use the data to empower their internal process, making client-facing apps, etc. Other customers could be startups, hedge funds, universities, and anyone needing financial data (from HRs to construction). The proportion's hard to estimate, but investors are not the prevailing audience. Points of contact are usually either tech people or product owners.

Why would someone buy data?

Data serves multiple purposes. It can be analyzed, incorporated into applications, employed in investment decision-making, harnessed to create trading systems, or used to scrutinize economic sectors. The applications are as vast as one's imagination and intellect.

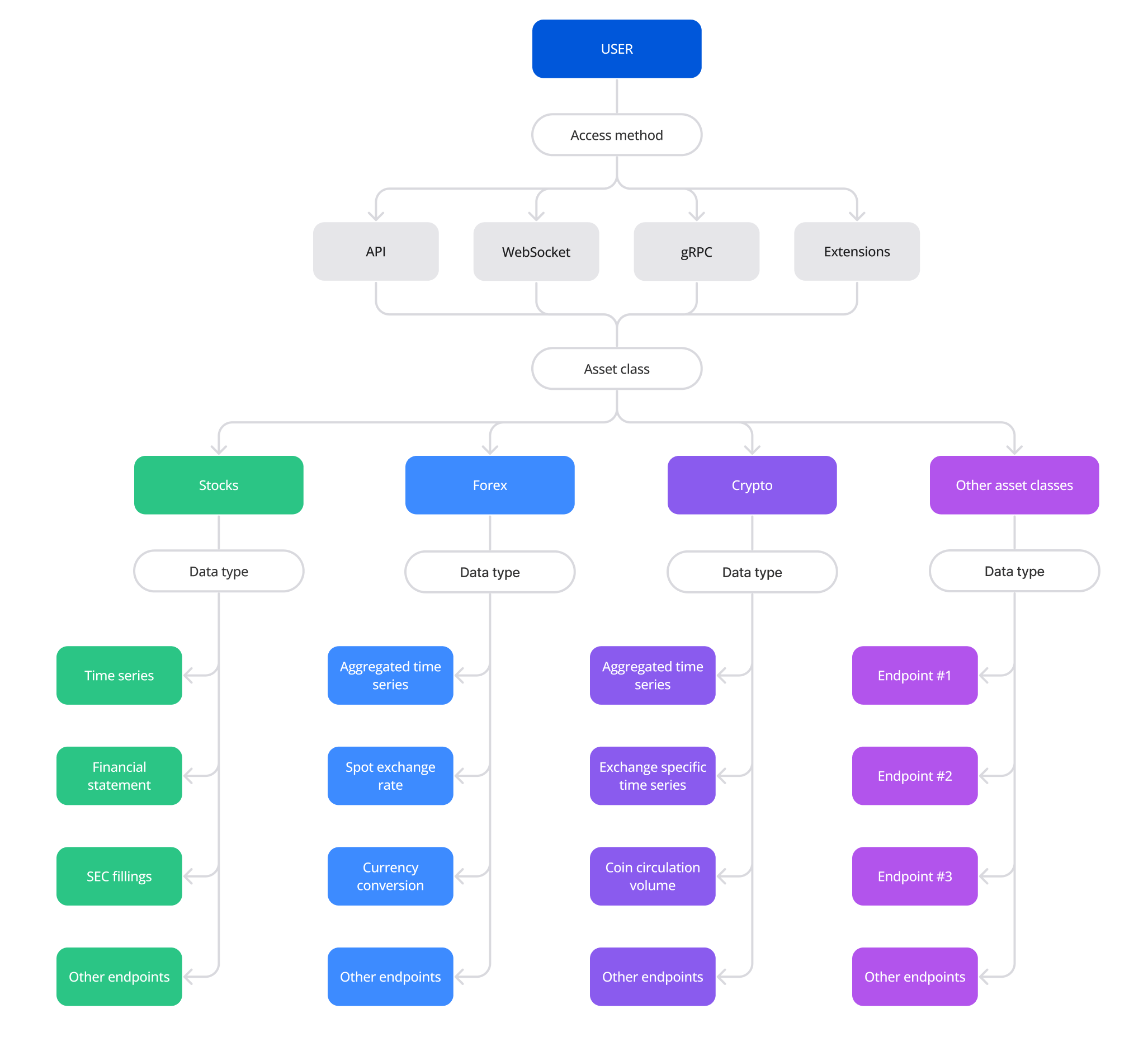

How do you access purchased data?

We equip developers with various options to procure this data: API, WebSocket, and gRPC. We aim to make data retrieval a seamless experience for developers, and we take pride in the convenience we offer.

For developer-centric resources, you can refer to our documentation.

Alternatively, non-tech people can use our data via the Google Sheets add-on or Excel add-on.

How do we generate revenue?

We charge users a subscription fee for a specific dataset. If a buyer's subscription ends, they keep the old data but can't get new updates. Buyers can choose features they want in a dataset, and the price changes based on what they pick. Features can be things like who's buying (a person or a company), how fresh the data is, how fast they get it, and how they get it. Every dataset can have different features to pick from. We are unique because we let buyers customize their datasets without predefined bundles.

- You can go to the catalog and check the customization parameters of various datasets.

- For more details about pricing, you can read here.

- Our master plan can be read in this article.