What is a SIP?

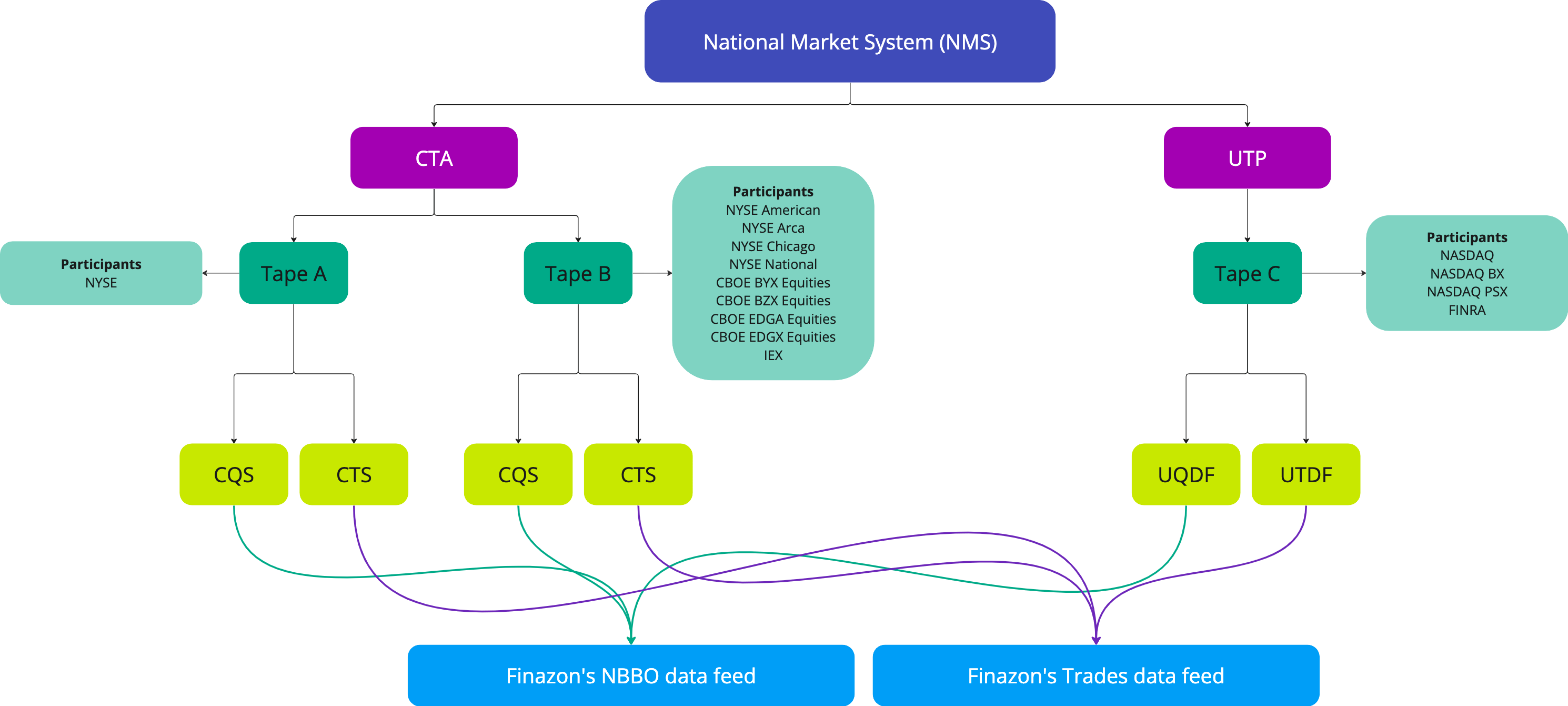

At its core, a Securities Information Processor (SIP) is a commercial entity responsible for gathering, processing, and distributing real-time bid/ask quotes and trade data from various US stock exchanges. SIPs serve two primary functions: promoting transparency for investor safety and determining the National Best Bid Offer (NBBO) price. Presently, there are two SIPs for US equities: the Consolidated Tape Association (CTA) and the Unlisted Trading Privileges Plan (UTP).

CTA

Operated by the New York Stock Exchange (NYSE), the CTA comprises two networks, Tape A and Tape B. Tape A is exclusive to the NYSE, while Tape B encompasses Bats, NYSE Arca, NYSE American, and other regional exchanges.

Two systems transmit data to the world from both tapes: the Consolidated Quote System (CQS) and the Consolidated Trade System (CTS). The former streams the best bid/ask quotes for a specific tape, while the latter provides comprehensive information about executed trades.

UTP

Managed by Nasdaq, the UTP offers only Tape C, which incorporates information from all Nasdaq-related exchanges, including Nasdaq's BX, PSX, and Finra.

The structure and system of the UTP follow the same logic as the CTA, offering the UTP Quotation Data Feed (UQDF) and UTP Trade Data Feed (UTDF).

Regulation National Market System (Reg NMS)

Reg NMS is a set of rules established by the SEC in 2005 to increase market data transparency and efficiency. Among several key rules, the most pertinent to our discussion is the National Best Bid and Offer (NBBO), which represents the tightest bid-ask spread for a security's price. The SEC requires brokers to execute trades at the NBBO price or better. The NBBO is calculated based on quotes received via the CQS and UQDF.

Example

Apple Inc.'s stock is listed on Nasdaq but can be traded on any other stock exchange. Prior to SIPs, exchanges executed trades at prices that did not necessarily reflect the current market price, resulting in unfair conditions for traders. With the introduction of SIPs, each exchange must report all quotes and trades to ensure a single, accurate source for real-time stock prices.

Fees structure

SIPs charge fees to cover the costs of collecting and disseminating market data and to generate revenue for the exchanges providing the data.

Fees depend on whether you're a non-professional or professional subscriber. Non-professional status requires confirmation that you use the data exclusively for personal, non-commercial purposes. As a non-professional subscriber, you pay no fees and gain immediate access to the data. All other circumstances classify you as a professional subscriber, requiring a direct agreement with the SIPs and payment of the relevant fees.

| Mode of access | Use | ||||

|---|---|---|---|---|---|

| Direct (co-location) | Indirect (via Finazon) | Non-display | Display (10 terminals) | Redistribution | |

| Tape A | 3000 | 2000 | 4000 | 270 | 1000 |

| Tape B | 2000 | 1000 | 2000 | 23 | 1000 |

| Tape C | 2500 | 500 | 3500 | 240 | 1000 |

| Total | 7500 | 3500 | 9500 | 533 | 3000 |

For example, if you are a payment processing company that needs data exclusively for non-display usage, your fees would be $17,000 if you co-locate servers with CTA & UTP or $13,000 if you receive data via a provider (e.g. Finazon). Another example would be a brokerage firm requiring data for display on customer terminals, in which case you will pay access fees (co-location or via Finazon) plus display charges

Why is the data so expensive for professionals?

SIPs redistribute profits to participants as a reward for providing quotes and trades. This incentivizes exchanges to compete for the best quotes and execute trades at the best price, thereby promoting market efficiency. Considering that the annual revenue of SIPs averages $400 million, it presents a substantial incentive for market participants.

History

The history of Securities Information Processors (SIPs) dates back to the 1970s, during a period of rapid growth and modernization in the US stock market. In 1975, the Securities and Exchange Commission (SEC) mandated the creation of a consolidated system for disseminating trade and quote data from multiple exchanges. This led to the formation of the Consolidated Tape Association (CTA) in 1976.

Over time, the role of the CTA expanded to cover additional market data, including options pricing data. In 1994, the Unlisted Trading Privileges Plan (UTP) was established to provide real-time data for stocks trading on alternative trading systems (ATSs) and other unlisted stocks.

Regulation

SIPs are overseen by the US Securities and Exchange Commission (SEC). One of the key regulations that SIPs must comply with is the Regulation National Market System (Reg NMS), which was implemented in 2005.

Under Reg NMS, SIPs must provide fair and equal access to market data for all market participants. This means they must offer the same data to all vendors and subscribers at the same time and cost. SIPs must also comply with strict rules regarding the accuracy and timeliness of the data they disseminate.

In addition to Reg NMS, SIPs must comply with other regulations, such as the Securities Act of 1933, the Securities Exchange Act of 1934, and the Investment Company Act of 1940. They are required to have robust systems and procedures in place to ensure the data they provide is accurate and reliable.

To ensure compliance with these regulations, SIPs undergo a rigorous approval process before being allowed to operate in the US stock market. Periodically the CTA and UTP must demonstrate their ability to collect, process, and disseminate market data consistently and promptly. They must also have appropriate systems and controls in place to ensure the security and integrity of the data they handle.

Criticism of SIP

While SIPs play a critical role in providing market data to traders and investors, they have also faced criticism and have some disadvantages. One of the main criticisms of SIPs is that they can be expensive for market data vendors and subscribers. SIPs charge fees to vendors and subscribers who use their data, which can be costly, especially for smaller firms. We at Finazon believe that fixed fees for non co-location services should be removed, leaving only variable costs. This would allow businesses to expand their consumption of data as they grow, eliminating entry barriers.

The latency of the data provided by SIPs can be a disadvantage for high-frequency traders who rely on ultra-fast data to make trades. Since quotes and trades must pass through several processing servers from exchange to SIP to customer, additional latency is introduced. Although the difference of a few microseconds is insignificant for 99% of users, HFT trades might prefer to choose direct co-location with the exchange.

Another drawback could be for brokerages that require depth order book data (Level 2), as SIPs were designed to provide only the best bid/ask price (Level 1).

SIPs Performance Metrics

Now, let's discuss some facts and figures about SIPs.

Resiliency

First, SIPs are remarkably resilient. They are designed to handle large volumes of market data, even during periods of high market volatility. This includes a backup server running in parallel to back up one another in case of disaster. The SLA for SIPs is set at 99.98%, with 100% availability in practice for the past several years.

Latency

The latency of SIPs has improved significantly over the years. Today, the average latency for the CTA and UTP is less than 20 microseconds, with some users experiencing latencies as low as 10 microseconds depending on their network setup and proximity to the SIP data centers. This level of latency is more than sufficient for the vast majority of traders and investors, excluding high-frequency traders who rely on faster data feeds.

Capacity

SIPs can handle massive amounts of data. As of 2023, CTA and UTP had a combined capacity of processing up to 25 million messages per second. This capacity is continually expanded to accommodate the growing volume of market data.

Accessing SIP Data

Accessing SIP data depends on your specific requirements. For ultra-low latency applications that demand minimal delays, physical co-location in SIP data centers may be the most suitable approach. While this option involves additional hardware costs and increased fees, it is recommended for business cases that necessitate minimal latency.

For all other scenarios, obtaining SIP data through a data vendor, such as Finazon, might be the optimal choice for both technical and financial reasons. Most data vendors offer user-friendly APIs that enable easy and rapid integration with your applications. Nevertheless, it is crucial to verify data quality, even when sourced from a reputable provider. Accessing SIP data requires processing millions of messages per minute and adhering to UTP and CTA technical specifications. Surprisingly, not all providers strictly comply with these guidelines, resulting in data that deviates from actual prices.

Financially, working with a market data provider is a prudent decision, as indirect access to SIPs typically incurs lower fees. Moreover, API data and other forms of access are generally more affordable.

At Finazon, we capitalize on economies of scale and promote transparency. By offering full customization of SIP datasets and a variety of configurable parameters, such as delays, API call volumes, and streaming data, we enable individual and business users to tailor costs to their specific needs. Our team of engineers processes, standardizes, aggregates, and stores terabytes of data in our robust, custom-designed infrastructure, ensuring the highest quality data with minimal latency.

Wrapping up

SIPs data is commonly recognized as the gold standard for obtaining real-time market data and obtaining a comprehensive view of trading activity in the US, as it is the only source that provides complete market volume information. Leveraging advanced data collection, processing, and distribution systems, SIPs empower market participants to remain informed about trading activity, bid/ask quotes, and other essential market details. Although there may be constraints for specific specialized use cases, for the vast majority of traders and investors, SIPs data offers a highly efficient and cost-effective means to access precise and current market information.