Evolution

Since it was launched in 2019, IEX Cloud evolved from offering a small subset of data primarily from its own IEX Exchange to covering SIP data and various corporate actions. Its main competitive advantage was the reliable infrastructure and dedicated engineering team.

Reasons

IEX Cloud cites its decision to refocus on its primary exchange business as the main reason for its exit:

This decision allows IEX to focus on the growth of our core exchange business as IEX Cloud was running at a loss and represented less than 2% of IEX Group overall revenue.

Source. Screenshot of IEX Cloud announcement.

Possibly, increasing competition from new companies, which specialize exclusively in market data with more accurate data, redundant infrastructure, and enhanced user features, also played a role.

Transition from IEX Cloud to Finazon

Officially, IEX Cloud refers all the existing customers to Intrinio. While it's a good market data company, their pricing might be unaffordable to most customers. For instance, EOD historical prices start at $3,100 annually, and Finazon offers the same data for $576 annually without a long-term commitment, with monthly payments, and with the ability to configure the dataset to your needs.

The same applies to other datasets: Fundamentals, ETFs, Stocks, Mutual funds, etc.

With a promo code IEXCLOUD2024 Finazon offers IEX Cloud users :

- 15% discount on all datasets.

- Extended trial period to assess our system and data.

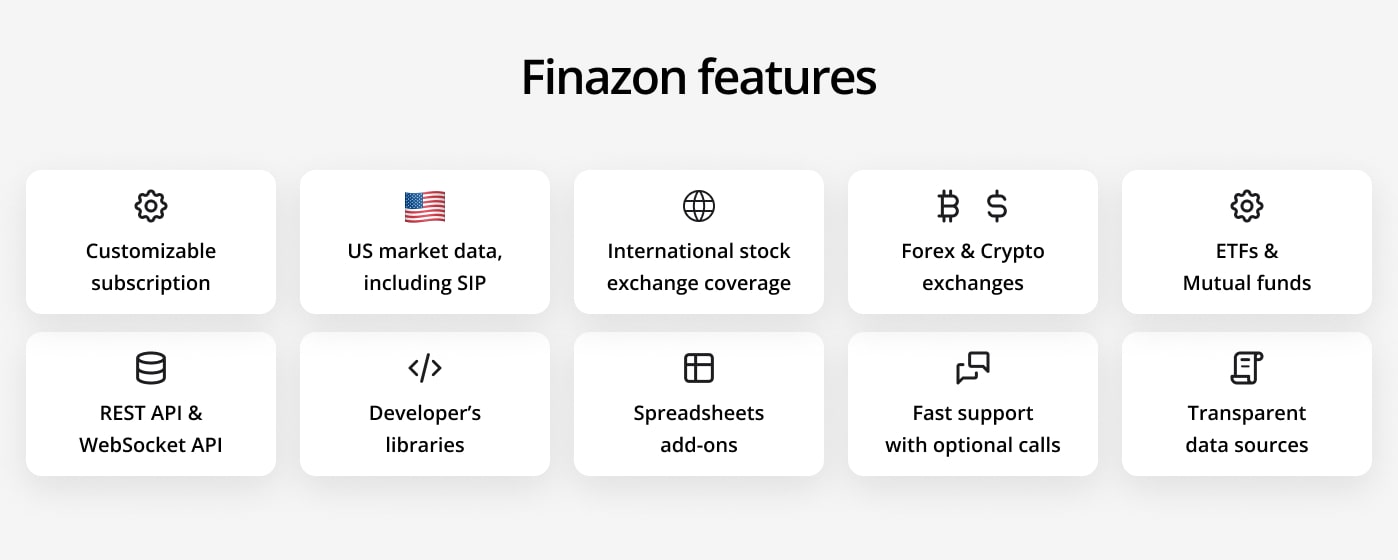

Finazon products that correspond to IEX Cloud products

- Equities Market Data = US Equities Max

- Historical Data = US Equities Max | Basic

- IEX Bid, Ask, and Last Trade = US Equities Basic

- IPOs = US IPO

- News = US Stock News

- Forex/Currency = Forex | Crypto Consolidated

- Reference Data = Finazon reference data

If you have any questions, or wish to discuss transitional matters, please feel free to contact us at [email protected].